A Medigap enrollment form and some cash Medigap is Medicare supplement insurance, which can help pay for health care costs that Medicare Parts A and B don’t cover. You will usually need to have Medicare Part A and Part B to buy a Medigap policy.

Medigap policies cannot be obtained with Medicare Advantage.

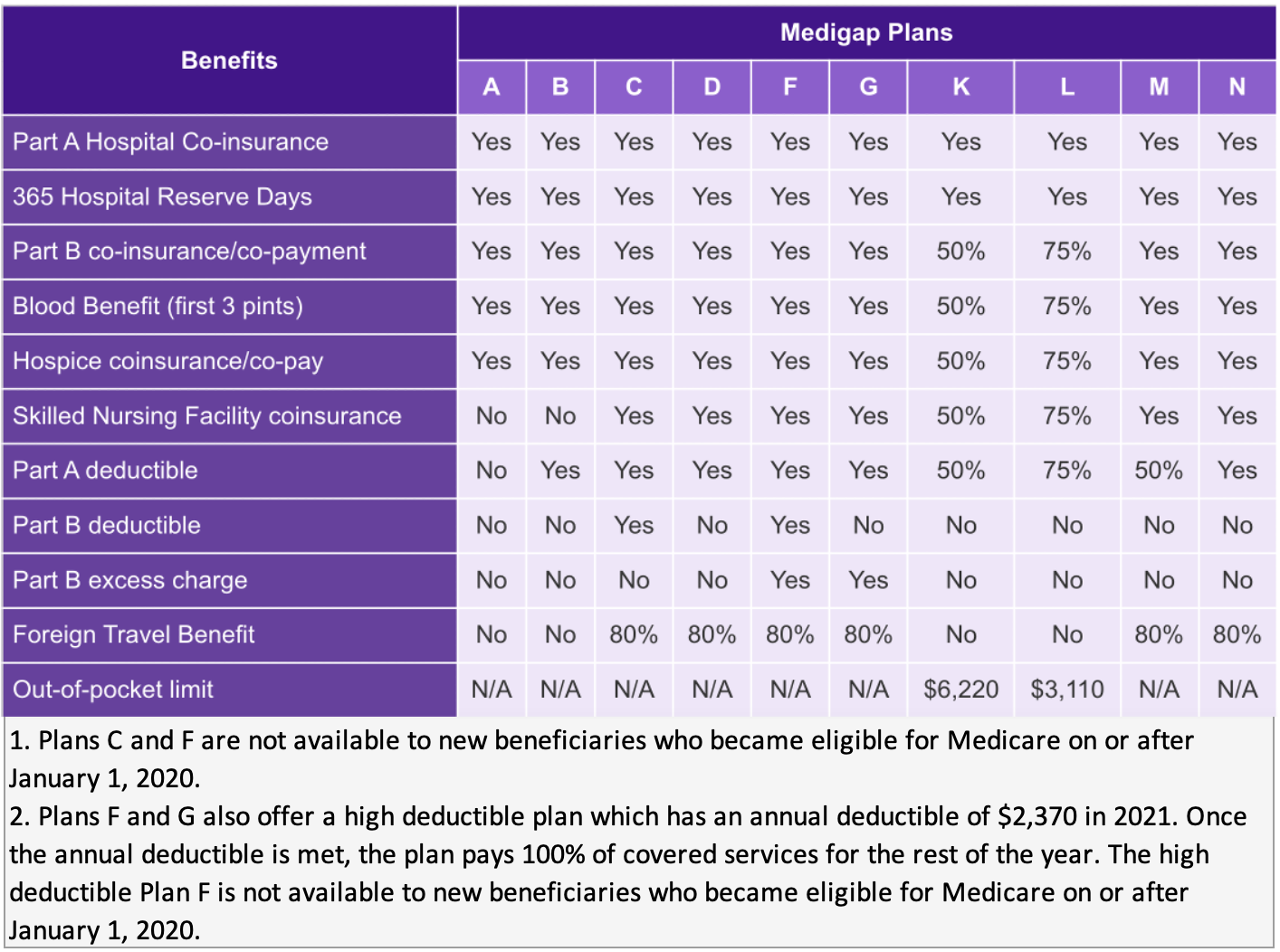

Private health insurance companies such as Blue Cross and Blue Shield, HealthNey, and Humana provide Medigap insurance. A Medicare supplement policy must follow Federal and state laws. In most states, there are 10 different, standardized Medigap plans available, labeled with letters: A, B, C, D, F, G, K, L, M, and N.